Taxes and Accounting for Full-Time RVers Working on the Road

|By Lindsey Nubern and Adam Nubern|

DISCLAIMER: The information and materials we share in this article are intended for reference only. As the information is designed solely to provide guidance to the readers, it is not intended to be a substitute for someone seeking personalized professional advice based on specific factual situations. Therefore, we strongly encourage you to seek the advice of a professional to help you with your specific needs.

Most of us proudly identify ourselves as full-time RVers, digital nomads, or van lifers, because we’re living the dream. We get to travel full-time and work remotely on the road.

Our lives aren’t normal. We don’t live in a sticks and bricks lifestyle like most people. We have the freedom to roam and be in any state we want at any time.

For some of us, this expands our work opportunities and we use our RV to travel the country for work trips.

In a normal sticks and bricks lifestyle, we could claim these business travel expenses as deductions on our taxes.

However, since our lifestyle isn’t normal and we’re always on the move, our taxes and travel deductions aren’t normal either.

So, can we deduct our travel expenses on the road?

The answer is complicated and depends on each RVers particular situation. Here’s why.

Who We Are: We’re Nomads

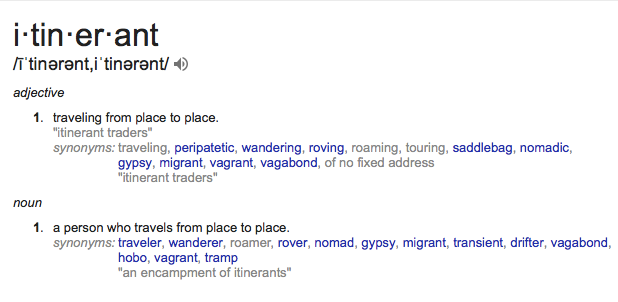

It’s all because of our nomadic lifestyle. Officially, the IRS calls us “itinerants.”

What is an itinerant?

Check this out: “an encampment of itinerants.” That’s our fun Escapades!

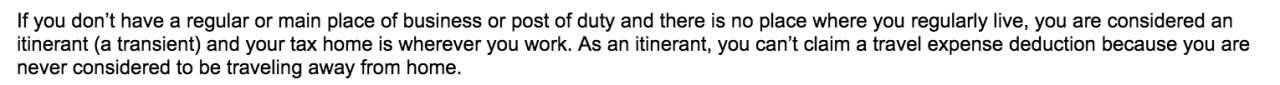

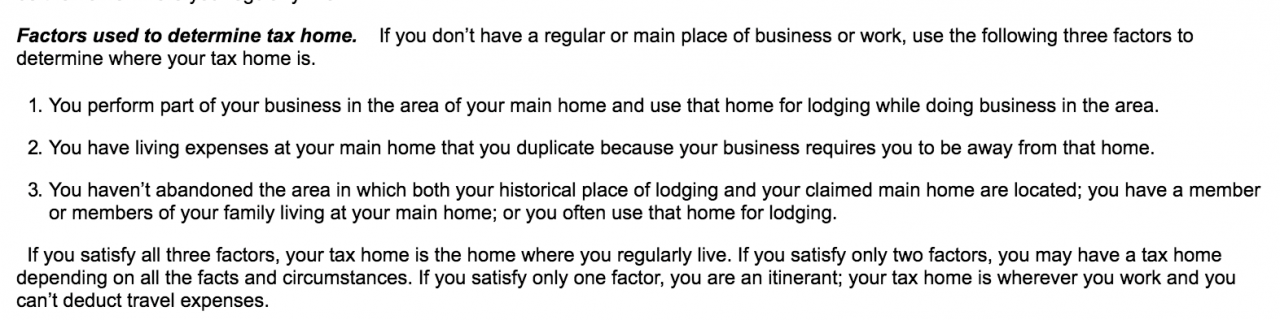

Here’s what the IRS says about itinerants: Source

At first glance, this looks pretty cut and dry. “As an itinerant, you can’t claim a travel expense deduction because you are never considered to be traveling away from home.”

Wait! We’ve dug deeper. You still have a chance to deduct your mileage.

Depending on your facts and circumstances, you may be able to deduct your travel expenses.

To do so, lets get an understanding of your tax home. Your tax home determines if you can deduct your travel expenses.

Tax Home

What is a tax home?

Your tax home isn’t the place you live. It’s the place you work.

For us living and working from our RVs, we have to take extra steps and keep track of our current tax home. Due to changing travel plans and situations, our tax home may change often.

The IRS gives us instructions on how to determine where your tax home is. It’s based on meeting a certain number of factors.

As the last paragraph states, if we only satisfy one of the three factors, we cannot deduct our travel expenses because our tax home is wherever we are currently working.

So, to be able to deduct our travel expenses, our goal is to try and satisfy two factors that are given above. By satisfying two factors, we may have a tax home depending on our facts and circumstances.

A Better Understanding of Each Factor

Factor 1: Most of the time, we satisfy Factor 1 because our main home is our RV and we use it for lodging while working from our computers doing business.

Most of the time, this is the only factor we satisfy as we travel around the country doing work from our RV. When we only satisfy this factor, we cannot deduct our travel expenses.

Factor 2: Factor 2 comes into play when there’s a situation causing you to duplicate your living expenses when you’re away for a business trip.

Duplicating expenses for a business trip could look like this: This month you are paying for a month’s rate at an RV park. During the same month you fly to another state for work. While you’re in the other state you pay to stay at a hotel.

With this example, you are duplicating living expenses by paying for your stay at the RV park and at the hotel.

However, most of the time when we are away duplicating our expenses for a business trip, we don’t satisfy Factor 1 any more. This is because we have left our RV (our main home). While we are away, we are no longer using our RV for work or lodging.

So, with this situation we still only satisfy one factor, Factor 2, and we cannot deduct our travel expenses.

Now, let’s look at Factor 3. It’s a game changer.

Factor 3: When you’re away from your main home (your RV) for a business trip, you haven’t abandoned your main home because you intend to return to it after your trip and continue traveling. Also, you often use your main home (your RV) for lodging.

So, when we’re away on business trips like the example above, we may satisfy two factors, Factor 2 (duplicating our expenses) and Factor 3 (not abandoning our RV), to be able to deduct our travel expenses.

As you can see, the number of factors you satisfy may change often with your changing situations.

To get a better understanding of how we may apply these factors in different situations, here are two examples.

Example 1

Kasey is a wedding photographer. She lives full-time in her RV and she works full-time out of her RV. She’s currently in Vermont’s Green Mountains at Hapgood Pond Campground.

Kasey has a wedding booked in Oregon in a few weeks to take professional pictures for the bride and groom. She’ll be driving her RV over to Oregon for the wedding. Kasey plans to stay on the west coast for a while since she’s in the area.

Can Kasey deduct her travel expenses from Vermont to Oregon?

No.

Looking back at the three factors used to determine tax home, Kasey only satisfies one factor, Factor 1.

Factor 1: Satisfied

She is working and lodging in her main home (her RV).

Factor 2: Not Satisfied

Kasey’s business trip situation doesn’t match Factor 2. She’s not duplicating any expenses for her trip.

Factor 3: Not Satisfied

Kasey hasn’t abandoned her RV (her main home) at any time.

Conclusion

Kasey’s situation only satisfies one factor. Therefore, she is considered an itinerant and she cannot deduct travel expenses.

Example 2

Kasey is a wedding photographer. She lives and works full-time out of her RV. She’s currently in Vermont’s Green Mountains at Hapgood Pond Campground for the summer. She’s been there for a month and she is planning on staying for another two months.

Kasey has a wedding booked in Oregon in a few weeks to take professional pictures. She’s decided to fly cross-country for the business trip instead of drive her RV.

Kasey adds all of these facts and intentions to her travel log to record her justification that this is a business trip.

Can Kasey deduct her travel expenses from Vermont to Oregon?

Yes. Looking back at the three factors used to determine tax home, Kasey satisfies two factors, Factors 2 and 3.

Factor 1: Not Satisfied

Kasey regularly works from her main home which is her RV. She vacates her RV for work in this example, so she does not satisfy Factor 1.

Factor 2: Satisfied

However, Kasey duplicates her expenses for the trip by paying for her RV to stay in Vermont at the campground and for her living expenses in Oregon while she’s shooting the wedding. So, Kasey satisfies Factor 2.

Factor 3: Satisfied

Factor 3 is satisfied, because Kasey is not abandoning her RV in Vermont during her trip to Oregon. She intends to return to her RV after the wedding event is over.

Conclusion:

Since Kasey’s situation satisfies two factors, she has a tax home (her RV) in Vermont while she travels to Oregon for the business trip. Kasey can deduct these business travel expenses.

As you can see, throughout the year you may be able to deduct travel expenses for some trips, but not others.

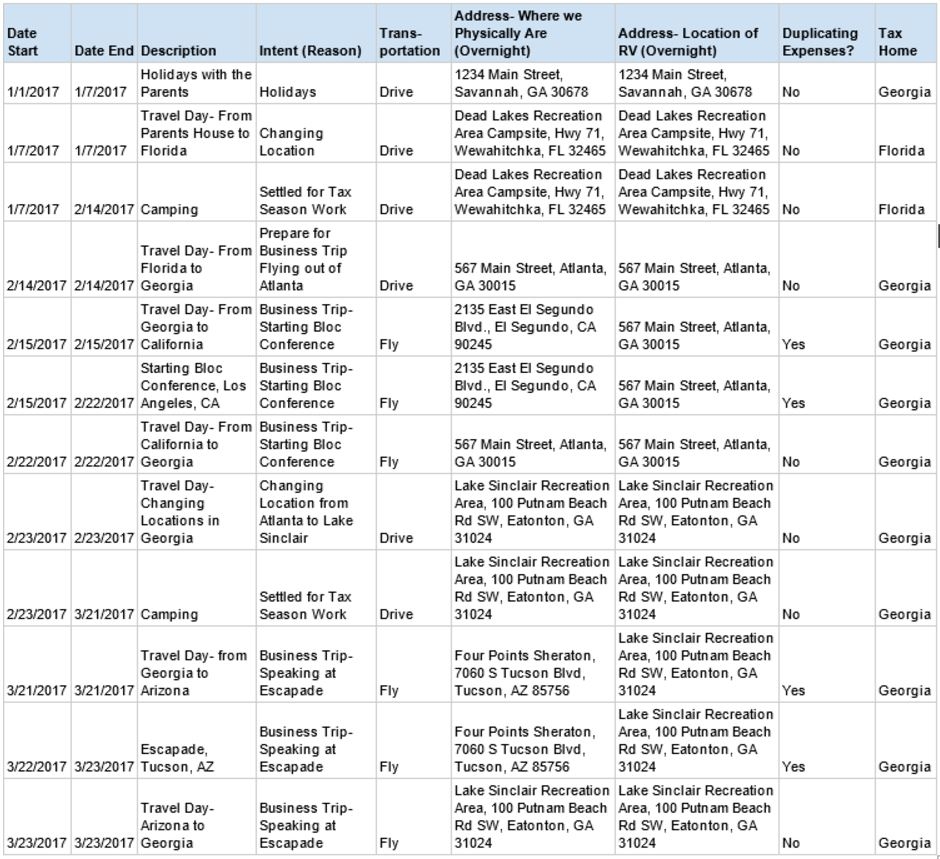

Since our tax home status can change from day- to-day, week-to-week, or month-to-month, it’s important to keep very detailed records of your travels.

Here are some ways to keep record of your travel situations to justify your circumstances and intentions if you were to be audited.

How to Keep Records of Expenses

1. Keep a Travel Log

Keep an up-to-date travel log using dates, locations, and your intent for your trips.

Here’s an example.

2. Track & Keep Records of Your Expenses

It’s very important to keep records of your expenses. Especially, if you are deducting travel expenses because you are duplicating living expenses. You need to prove with paperwork you are duplicating your expenses where your RV is and where you are on your trip.

Remember To:

- Keep an up to date travel log (seen above)

- Record all expenses accurately in your accounting records

- Keep all receipts

Tip: Use Accounting Apps to Help You Track Your Expenses

- QuickBooks has a phone application allowing you to attach pictures of receipts to you expenses. This saves you from keeping stacks of receipts.

- Mile IQ has a phone application to make tracking and recording your mileage easier.

Need a CPA?

Xscapers works with CPA Adam Nubern of Nuventure CPA. Connect with Adam here.

DISCLAIMER: The information and materials I have shared in this article are intended for reference only. As the information is designed solely to provide guidance to the readers, it is not intended to be a substitute for someone seeking personalized professional advice based on specific factual situations. Therefore, I strongly encourage you to seek the advice of a professional to help you with your specific needs.